Latin America is well-positioned in a great place as both a consumer and news and media creator. While freedom of the press might look different in some countries, each country offers opportunities and excellent news coverage. In Latin America, a healthy percentage of users paid for digital news. For example, 18% paid for news in Mexico, Brazil, over 17%, and Peru, around 16%1 Newspapers also reached Latin American countries in 2019, with Peru at 64.3%, Colombia at 48.5%, and Ecuador at 47.3%.2

Freedom of Press

According to the International Consortium of Investigative Journalists, “The risks of reporting in Mexico are among the most alarming signs of eroding press freedom in Latin America, where journalists have been murdered, jailed, restricted from accessing public information, and systematically harassed through social media campaigns this year. In several countries, governments limited or tried to criminalize funding for independent media. Yet, Latin America reporters, including many members of the International Consortium of Investigative Journalists and partner media outlets, have defied threats and censorship by continuing to publish work that exposes abuses and holds the powerful accountable.”

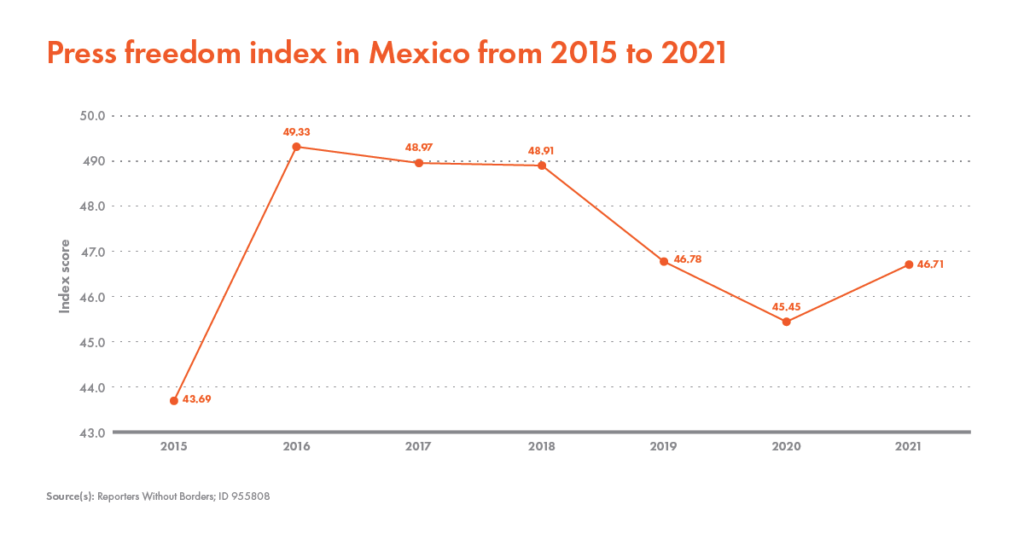

However, the landscape for freedom of the press and news is changing slowly for the better. In Argentina, the numbers rose to a positive 28.99% in 2021.3 In Brazil, 2021, it was 36.25%, Chile rose to 27.89%, and Cuba decreased to 63.94% in 2021 from 71.75% in 2017. Guatemala rose to 38.45% in 2021, Venezuela had a percentage of 47.6 in 2021, and Mexico was 46.71% in 2021.4

Argentina

Argentina consumes news several times a day 53%, and out of those consumers, around 28% use TV newscasts such as cable or broadcasting. People also use traditional newspapers and TV websites to get their news by 21%. Some of the most popular platform used to access and follow digital news in 2020 was social media (56%), online news portals (54%), and social media profiles (35%), to name a few. The most popular devices to access news in Argentina are smartphones (used by 18 to 29 years old), computers (50 to 65 years old), and tablets (50 to 65 years old). Most of these digital news consumers did not pay for news (86%), while paid subscribers amounted to only 14%.5News consumers aged 35-44 used Facebook 61% more than other platforms and age groups.6 Argentina is home to some of the most trusted digital news channels, such as Infobae (45%), La Nación (40%), and Clarin (33%).7

Brazil

Brazil consumers spend over 23% of their time digesting news from TV newscasts and social media by 18%.8 In 2021, internet users from 34 to 44 of age consumed media from online newspapers, magazines, and broadcasting news the most.9 However, some of the leading offline news brands in 2021 were Globo (46%), Record (36%), and SBT (29%).10 On the other hand, digital news was mostly consumed using social media (62%), news portals (52%), and social media (44%). The devices used to access digital media were smartphones (used mainly by 92% of 18 to 39 years old), computers (used 64% by 50 to 65 years old), and tablets (with low usage of 14% of 20 to 29 years old).11 Social networks were used as news channels; Facebook was the most popular at 47%, which was also used by mostly 45 to 54 years old (by 53%), WhatsApp by 43%, and YouTube by 39%. That being said, the most trusted digital news media outlets are G1 (48%), R7 (39%), UOL (37%), and many more.12

Chile

Chile continues to have selected news media sources such as online and social media by 84%, social media by 69%, TV by 68%, and print by 23%. Some of the most popular offline news are Chilevisión (46%), Meganoticias (42%), Canal 13 News (39%), and others. While on the other hand, some of the leading online news in 2021 were Emol (28%), Bio Bio Chile, and 24horas online (24%).13 The news web places with the most unique visitors are Latercera with 7.39 million, Biobiochile with 7.38 million, and 24horas with 7.02 million.14 Consumers only have a certain level of trust toward mentioned news brands. In 2021, consumers trusted Bio Bio Chile only 59% and Cooperativa and CNN (57%). Consumers love social networks as a way to get their news. Facebook leads the numbers by 54%, WhatsApp (36%), Instagram (27%), and more.15

Colombia

The frequency of which news is consumed in Colombia can range from once a day to several times a day (30-46%). Consumers primarily use TV newscasts (23%) to get their information followed by traditional newspapers or TV sites (18%). The platforms mostly used to access and follow digital news in 2020 were social media (60%), news portals (55%), and social media (47%). Of the devices used to access digital news in 2020 were smartphones by, 93%, with ages 18 to 29 using them the most. Followed by computers by 71% and users 50 to 65 years of age, and tablets by 23% from ages 50 to 65. Most users didn’t pay for any digital news by 85% in 2020. On the other hand, the most trusted digital news media where El Tiempo (47%), Noticias Uno (44%), and El Espectador (43%).16

Mexico

Beyond the turbulence, the consumers in Mexico consume news several times a day 39% and use TV newscasts like cable and broadcasting (22%), social media (19%), and traditional newspapers and websites (18%).17 Some of the leading offline news brands in 2021 were TV Azteca News (43%), Televisa (35%), and El Universal (25%), to name a few. On the online side, some of the most popular brands were El Universal Online (30%), UnoTV Online (25%), and TV Azteca News Online (24%).18 The platforms used the most to access digital news content in 2020 were social media (59%) and online news portals (43%). Only 92% of consumers paid for digital news content out of that content. The trust might come hard for the locals, but some of the most trusted digital media news are El Universal (49%), Milenio (39%), Aristegui Noticias (37%), and more.19

In 2022, Mexico’s media giant Grupo Televisa and Spanish-language broadcaster Univision in the United States closed a $4.8 billion content merger. Just months after, the new media conglomerate TelevisaUnivision reached a deal with Hemisphere Media Group to acquire Pantaya, a U.S. streaming platform for Spanish-language movies and series, snapping up the rival streamer to bolster the ViX service.

Leveraging our partners in the Worldcom network, we offer companies the option to outsource their international marketing communications strategy and execution to our team of Advisors. To learn more about how we companies go global and reach their goals, feel free to contact our team of trusted advisors.

*This blog post was written by Laura Rentas-Giusti, head of the Comms practice at DuartePino, in collaboration with Luis Avellaneda from Worldcom’s partner firm Realidades in Perú.

References:

1. Reuters Institute for the Study of Journalism; YouGov; ID 718551

2. Grupo de Mídia São Paulo; ID 275984

3. Reporters Without Borders; ID 955732

4. Reporters Without Border

5. Luminate; Provokers; ID 1009512

6. Reuters Institute for the Study of Journalism; YouGov; ID 981986

7. Luminate; Provokers; ID 1178666

8. Provokers; Luminate; ID 283030

9. CETIC; CGI.br (NIC.br); ID 1085923

10. Reuters Institute for the Study of Journalism; YouGov; ID 308480

11. Provokers; Luminate; ID 1178597

12. Provokers; Luminate; ID 1178588

13. Reuters Institute for the Study of Journalism; YouGov; ID 718585

14. comScore; ID 1135215

15. Reuters Institute for the Study of Journalism; YouGov; ID 981892

16. Provokers; Luminate; ID 1179120

17. Luminate; Provokers; ID 1011516

18. Reuters Institute for the Study of Journalism; YouGov; ID 718444

19. Luminate; Provokers; ID 1178561