South America is home to numerous countries with immense growth potential and opportunities for any business owner. Counties such as Argentina, Brazil, Chile, Colombia, Ecuador, Guayana, Paraguay, Peru, Uruguay, and Venezuela are some of the most exciting places to visit and embrace as a home for your next big expansion projects. South America’s geographic location also makes it a great place to be connected to other powerful countries. Latin America and the Caribbean have a total population of 652.28 million people just in 2020, with a steady growth rate.1 The average age consists of a median of 15 to 64 years old.2

The Economy and Trade

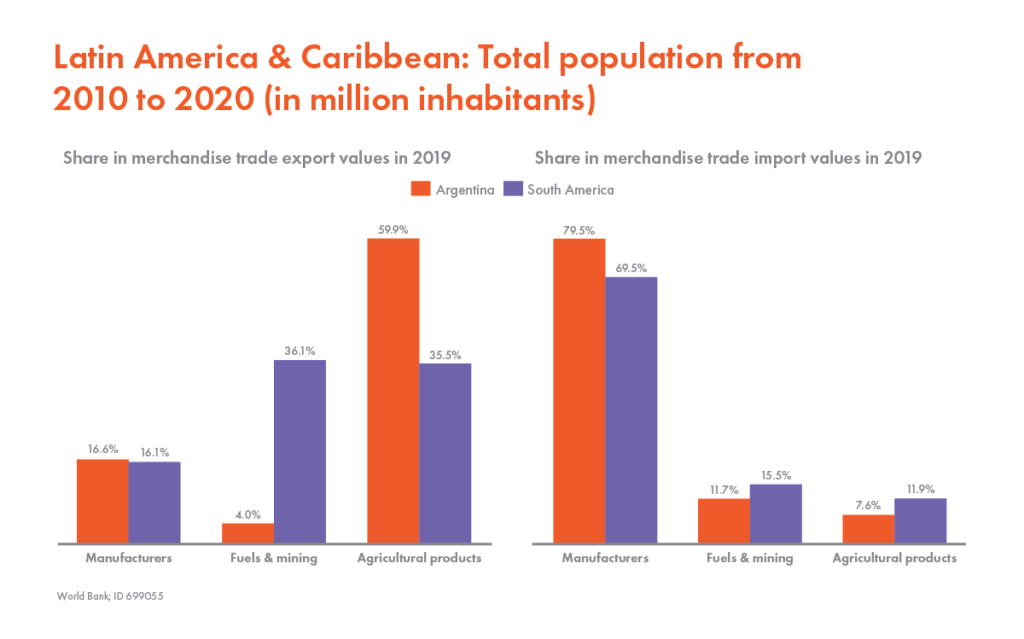

The leading sectors in South Americ are tourism, oil, agriculture, and trade. In Argentina, the gross domestic product projected for 2026 comes to USD$536.23 billion dollars with a trade balance of goods of USD$12.53billion just in 2020 alone.3 In 2020, the export goods totaled USD$54.88 billion, with exports of agricultural products worth over USD$36.09 billion, followed by manufacturing at USD$7.92 billion.4 It also takes around 11.5 days to start a business in Argentina instead of the average of 42.6 days. Starting a business is also much higher than the regional average in 2020.5

On the other hand, in Bolivia, the gross domestic product is expected to be USD$53.93 billion in 2026. Imports in 2020 were over USD$7.08 billion, while exports dropped and totaled USD$7.02 billion. Some of the leading export partners working with Bolivia consist of Argentina (16%), Brazil (15%), and United Arab Emirates (12%), to name a few.6 Creating a business in Argentina takes a bit longer, at 39.5 days.7

Brazil has been booming steadily, with an expected growth reaching USD$2,447.68 billion in 2026. Therefore, the growth rate in the real gross domestic product is expected to increase by over 2.04% in 2027. The most successful economic sectors in 2020 conceited services (62.92%), industry (17.65%), and agriculture (5.91%).8 Some of the leading companies in Brazil include Petrobras (USD$69.97 billion), Petrobras Distribuidora (USD$25.79 billion), and Ipiranga (UD$20.57).9 It takes over a week, around 17 days, to start a business in Brazil.10

In Colombia, it takes just ten days to start a business compared to the regional average of 42.6 days. The score for starting a business there was regionally higher. Colombia has natural resources such as oil reserves, gold, silver, emeralds, platinum, and coal. Real GDP is forecasted to grow by 3.8% p.a from 2020 to 2025. Sectors such as services rose by 57.6%GDP in 2019, followed by industry (27.7%) and agriculture (6.6%). In addition, some of the main U.S exports to Colombia include coffee, cut flowers, and oil.11

Ecuador is another prosperous country in the South American continent with a 2.4% p.a from 2020 to 2025 and a real GDP capita of USD$5,331.7 in 2020 — making it the 78th country with the highest real GDP per capita.12 Services accounted for over 51.9% of GDP in 2019, followed by industry (32%) and agriculture (9.5%). Unfortunately, it takes around 48.5 days to start a business.13 Banco Pochincha was one of the companies with the most revenue at USD$1,166 million.14 In 2019, the total merchandise exports totaled the amount of USD$22.3 billion. On a positive note, Ecuador has a higher export flow rate than other regions and is one of the most promising travel destinations and service-related exports.15

Paraguay, with a population of over 3.3 million just in Asuncion (one of their largest cities), has fruitful business maturity and prospects. Their real GDRP is expected to increase by 4.6% from 2020 to 2025, making them the 77th highest country, depending on the GDP per capita. Out of that GDP, over 50.4% is from services alone, followed by industry (32.2%) and agriculture (10.1%).16 Building a business in Ecuador is still a bit lengthy at around 35 days, but their score for starting a business was higher than the regional average in 2020.17

Suriname is not to underestimate, with a high export trade flow beating the regional average, merchandising exports totaling USD$2.1 billion, and services to USD$0.1 billion. Tech is making its way into the economy, with eCommerce generating over USD$13.8 million in 2025. In addition, FinTech is valued to grow by over 19.5% by 2025. Their real GDP is forecasted to increase by 2.3% p.a by 2025.18 Services accounted for 52.6% of the GDP, followed by industry (29.8%) and agriculture (9.7%) in 2019 alone. Their high export rate of manufacturing, fuels, mining, and agricultural products is higher than the regional average. However, you must be somewhat patient when doing business in this lovely place, as it takes over 66 days compared to the regional average of 42.6 days.19

Uruguay has one of the highest incomes in South America, with a population growing by 0.3% in 2021. Their real GDP forecast is expected to increase by 2.9% p.a from 2020 to 2025. As an ever-evolving place, its capita is at USD$16,668.1, making it one of the highest in the region. That being said, they are the 40th country with the highest real GDP per capita.20 Out of that number, services accounted for 60.9% of the GDP. Manufacturing is also a booming sector, with merchandising exports being higher than the regional average at over USD$7.7 billion in 2019. In 2020, they also reported one of the highest increases in export trade flows compared to the regional average and it only takes 6.5 days to start a business there, making it a great place to get on the ground running.21

Peru might have a low export trade compared to the regional average, but its steady population growth, and average speed in building a business, make it a place worthy to invest in. Their real GDP is expected to increase 5.0% p.a by 2025, making it the 72nd country with the highest real GDP per capita; Lima ranks as the city with the highest per capita at a whooping USD$11,095, where services accounted for 54.9% of the GDP in 2019.22 If you have time and patience, it only takes 25 days to start a business in Peru, which lands them in a positive light as one of the ease of starting a business by 59.1%. Lastly, Banco de Credit del Peru registered the most revenue in 2020 at USD$4,018.23

Chile is a high-income country with a population growing steadily at 0.5%. Their real GDP is expected to increase by 3.2% by 2025. In 2020, Chile had a higher export trade compared to the regional average and in 2019, their merchandise export totaled USD$69.9 billion. Their real GDP per capita was higher than the average in 2020 by USD$14,316.4, meaning they were the 45th country with the highest GDP per capita. However, in 2020, their total services-related export totaled USD$6.2 billion. Santiago, on the other hand, had a GDP of USD$22,187; services accounted for 58.7% of their total GDP in 2019 alone, and it only takes 4 days to start a business in Chile! 24

Digital Infrastructure

According to research from WorldBank, “Even as the region is more connected than ever, countries in Latin America and the Caribbean (LAC) still face multiple digital gaps. About 200 million people lack access to basic digital infrastructure, and for much more such access is of poor quality or too expensive. Moreover, the COVID-19 crisis has reinforced the increasing use of technological solutions. Lockdowns triggered a swift but uneven transition toward digital interactions, including remote work, online education, e-commerce, digital health, and many other aspects of our lives that once took place in person. Today, however, the region lags behind more developed economies with more than a third of LAC households remaining unconnected.”

Tips on the Business Culture

- Avoid “Mexican” or stereotypical phrases.

- Take the time to build a connection, respect, and trust.

- Punctuality is not always rigid.

- Be warm and friendly.

- Learn the language.

- Dress to impress.

Leveraging our partners in the Worldcom network, we offer companies the option to outsource their international marketing communications strategy and execution to our team of Advisors. To learn more about how we help companies go global and reach their growth goals, feel free to contact our team of trusted advisors.

*This market profile was written by Gabriel Marrero Girona, Lead Intelligence Advisor at DuartePino, in collaboration with Luis Avellaneda from Worldcom’s partner firm Realidades in Perú and Angélica Consiglio from Worldcom’s partner firm Planin in Brazil.

References:

- World Bank; ID 699055.

- World Bank; ID 699084.

- IMF; ID 316724; WTO; Statista; ID 316671.

- Statista, 2022.

- Statista, 2022.

- Statista, 2022.

- World Bank, 2020.

- Brazil; World Bank.

- Brazil; Exame; 2017.

- World Bank, 2020.

- Statista, 2022.

- IMF, World Bank, European Commission, OECD, ADB.

- World Bank, 2020.

- Xignite 2021, Statista Company DB, 2021.

- World Trade Organization 2021; Statista 2021.

- IMF, World Bank, European Commission, OECD, ADB.

- World Bank 2019; Statista 2021.

- IMF, World Bank, European Commission, OECD, ADB, Statistica 2022.

- World Bank 2020; Statista 2021.

- IMF, World Bank, European Commission, OECD, ADB, Statista 2022.

- World Bank, 2021.

- Statista, based on IMF, World Bank, European Commission, OECD, ADB as of Q4 2020.

- World Bank 2020, Statista 2021.

- World Bank 2020, Statista 2021.